Market News – 03 January 2017

Happy new year and best wishes for 2017 from the team at Currency Global!

What a year 2016 was – Brexit and Sterling’s dramatic slide, Trumps election victory, oil prices plunging and the Dollar’s rally among others: we were never short of attention-grabbing headlines.

Yet there are still reasons to hope that 2017, like 2016, will not turn out as bad as the doomsayers predict. Surely, one lesson from last year is that when forecasters accentuate the negative they risk missing the positives altogether.

GBP

The expected triggering of Article 50 this quarter will play a key role in how Sterling trades early 2017. The start of two years of formal Brexit negotiations with Brussels is expected to drive the pound down by more than 5% against the Euro and Dollar, according to Bank of America and Deutsche Bank.

‘’We believe that the activation of Article 50 will be the crystallisation of Brexit fears and the final leg lower in the pound’’ said Kamal Sharma, a foreign exchange strategist at Bank of America.

Tesla Motors customers in the UK may find their Christmas cash goes a little further than expected after the car-maker postponed a price increase by two weeks.

The electric-car manufacturer’s plans to raise prices 5% in the UK pre-Article 50, have been put off until mid-January from the original beginning-of-the-year deadline.

Data this week –

Today: Markit Manufacturing PMI (Dec) 56.1

Wednesday: PMI Construction (Dec)

Thursday: Markit Services PMI

EUR

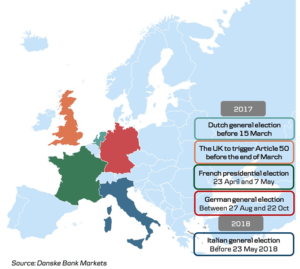

Elections in the Euro zone may bring turmoil to the bloc if support rises for anti-establishment nationalists. After reports that a respected German economist and head of the Ifo think tank had warned there might be a political backlash in Italy against the EU unless living standards, which have remained unchanged for 16 years, rapidly improve.

Italy’s Banca Monte dei Paschi di Siena, which is being bailed out by the state, plans to issue €15bn of debt next year to restore liquidity and boost investor confidence. The debt sales would be supported by government guarantees which form part of a liquidity scheme for banks in need, which the European Commission has agreed to extend for six months.

Data this week –

Wednesday: Consumer Price Index (YoY Dec) Preliminary

Thursday: Monetary Policy Meeting Accounts

USD

President-elect Donald Trump moves into the White House in less than three weeks and there is a risk he may start a trade war with China that could have global consequences.

The first true test of the Trump White House’s relationship with China may come in April, when the US Treasury releases a report looking at China’s currency. Trump has long maintained that China has been devaluing its currency in order to stack the deck on exports in its favour.

Following a period of consolidation between now and late January, we believe the Dollar will put on another 10 percent of gains over the next eighteen months,” said Richard Grace, chief currency strategist at Commonwealth Bank of Australia.

Data this week –

Today: ISM Manufacturing (Dec)

Wednesday: FOMC Minutes

Friday: Non-Farm Payrolls (Dec) and Unemployment rate (Dec)

Rest of the World

China’s yuan is likely to see more volatility against the US Dollar this year after its foreign exchange market operator changed the way it calculates a key yuan index by nearly doubling the number of foreign currencies in its basket.

The Indian Rupee has been hailed as one of Asia’s most stable currencies and a 2017 uptrend is likely. The Rupee has been less volatile than most developed nations currencies. Further, it has held its ground the best out of almost all currencies versus the strengthening Dollar.

India’s relatively balanced Current Account is likely to be the source of Rupee strength, with the possibility of a surplus in the next quarter, according to Prateek Agarwal, CIO of Ask Investment.