Market News – 15 January 2018

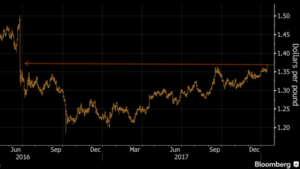

STERLING

Sterling was one of the strongest G10 currencies last week after a strong rally on Friday on speculation of a soft-Brexit. According to people familiar with the matter, Spanish and Dutch finance ministers have agreed to work together to push for a Brexit deal that keeps Britain as close to the European Union as possible.

Declines were seen on Wednesday after stronger-than-expected UK manufacturing and industrial production data was countered by weaker trade figures: -£4.6bln versus -£2.6bln.

The NIESR GDP estimate also beat slightly at +0.6% in the three months to December.

For the week, Sterling gained 1.7% versus the US Dollar, but lost 0.5% against the Euro and 0.7% versus the Yen.

(via Bloomberg)

EURO

The Euro was mixed last week. The single currency got off to a slow start but spiked higher on Wednesday after the ECB minutes struck a notably more hawkish tone than at the December press conference.

According to the account, the language pertaining to various dimensions of the monetary policy stance and forward guidance could be revisited sooner rather than later, with markets pricing in a 10 basis point hike at 76% before year end.

Further gains were seen on Friday after a breakthrough in German coalition talks.

US DOLLAR

The Dollar Index (which measures the currency against a basket of peers) lost 0.7% last week with the Greenback weakening against almost all its G10 rivals.

After a strong start, the Dollar fell on Wednesday after reports emerged suggesting that China are considering slowing or possibly halting their purchase of US government bonds. The sell-off continued Thursday after soft PPI and jobless claims data, although some support was seen after Chinese officials denied the Treasury story.

The Dollar Index has now dropped to a 3 year low despite slightly stronger readings for US retail sales and CPI as investors favoured the Euro and Sterling.

JAPANESE YEN

The Japanese Yen was one of the strongest G10 currencies last week. The bulk of its gains came on Tuesday and Wednesday after the Bank of Japan cut its purchases of Japanese government bonds, fuelling speculation that they could soon begin tapering their asset purchase program.

SWISS FRANC

Consumer price data released on Monday failed to prompt much reaction as headline CPI met expectations at +0.8% year-on-year.

Losses followed on Tuesday after the unemployment rate ticked up to 3.3% from 3.1%.

AUSTRALIAN DOLLAR

The Australian Dollar softened slightly on balance last week. Losses were seen on Wednesday after domestic CPI data came up short of expectations although retail sales beat expectations on Thursday and provided a modicum of support.

In the commodity space, the Australian government cut their iron ore forecasts.

CANADIAN DOLLAR

The Canadian Dollar weakened last week as concerns surrounding the future of NAFTA resurfaced. This followed comments from two Canadian government sources, who said Canada is increasingly convinced US President Trump will announce shortly that the US is pulling out of NAFTA.

Macro data may also have weighed after building permits slumped 7.7% in November.

NEW ZEALAND DOLLAR

The New Zealand Dollar strengthened for the most part last week. Domestic impulses were limited with a quiet data slate – building consents jumped by 10.8%.

Stronger than expected Chinese trade data released on Friday provided some support. Higher oil prices also played their part as US crude futures surged almost 5.0% for the week to their highest level since mid-2015.

SWEDISH KRONA

The Swedish Krona was mixed last week. Gains were seen in response to the Riksbank minutes on Wednesday where Governor Ingves said they have come a little closer to the point in time when monetary policy is expected to change direction and it should be possible to begin raising the policy rate here before the ECB raises its rate.

NORWEGIAN KRONE

The Norwegian Krone rose last week, boosted by the higher-than-expected CPI figures released on Wednesday. Elsewhere, the hawkish Riksbank minutes will have provided some support along with the multi-year highs for oil prices.