Market News – 25 September 2017

STERLING

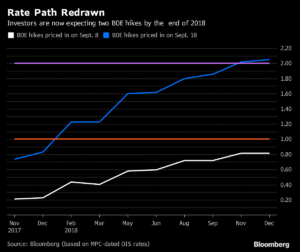

The pound fell last week, retracing some of the prior week’s bullish run, as Bank of England Governor Mark Carney walked back recent rate hike comments. Brexit, which prompted Mark Carney to cut U.K. interest rates for the first time in seven years in 2016, is now pushing in the other direction.

In a speech in Washington last Monday, the governor said while the decision to leave the EU has slowed growth, it’s also cut the economy’s potential.

(source:Bloomberg)

Britain’s banks could incur £30bn of losses on their lending on credit cards, personal loans and for car finance if interest rates and unemployment rise sharply, the Bank of England warned today.

After assessing the fast growth in the consumer credit market, Threadneedle Street is requiring the banking system to hold an extra £10billion of capital as protection against any future losses after finding that lenders are underestimating their exposure to bad debts in an economic downturn.

UK Prime Minister Theresa May’s Brexit blueprint speech in Italy also disappointed markets. May stuck to her ‘no deal is better than a bad deal’ mantra, while also stating that the UK will leave the single market and customs union, along with rejecting both EEA membership and Canadian-style model.

The PM went on to say that the UK will cease to be a member of the EU in 2019, however, confirmed that there would be a transitional period, which she hopes will be around two years.

UK data-wise, the retail sales report saw all four metrics beat expectations, alongside revisions higher across the board.

For the week, the pound lost 0.6% versus the US Dollar and 0.4% versus the Euro but was flat versus the Yen.

EURO

The Euro was mixed last week. Source reports were again in focus, with ECB policymakers said to disagree on whether to set a firm end date for bond-buying, sending the shared currency lower.

However, the down move was short lived as FOMC decisions in the US increased expectations that the ECB could start unwinding quantitative easing, possibly at the beginning of 2018.

We also saw better than expected Eurozone PMI releases and consumer confidence, with the latter hitting its highest level since April 2001.

German unemployment, EU wide inflation and Mario Draghi’s speech will all be in focus on Friday.

US DOLLAR

The US Dollar rose against most of its G10 peers last week, following a hawkish skew from the Fed, with more FOMC participants now viewing the December meeting as live for a hike. As such, Federal Funds Rate futures are pricing over 70% implied probability of a rate hike to 1.25% – 1.50%.

San Francisco Fed President Williams said he expects gradual rate increases over the next couple of years, with one possibly as early as December, and Dallas Fed President Kaplan said he’s keeping an open mind toward an increase that month.

JAPANESE YEN

The latest North Korean rhetoric spurred some safe-haven flows late in the week, however, the Yen was still lower against the majority of the G10 currencies.

The Bank of Japan held monetary policy steady at a policy review on Thursday and asked markets to have faith that inflation will hit its elusive 2% goal. However, board newcomer Kataoka dissented in favour of more stimulus. The Yen was initially weaker but pared some of its losses after the policy decision.

SWISS FRANC

The Swiss Franc was one of the worst performing G10 currencies last week, with the positive trading sentiment around equity markets early on seen weighing on the currencies safe-haven appeal.

Friday saw some safe-haven flows on North Korean rhetoric, after foreign minister Ri Yong Ho said a hydrogen bomb test in the Pacific Ocean was possibly in retaliation to fresh US sanctions. Meanwhile domestically, there was a lack of catalysts.

AUSTRALIAN DOLLAR

RBA Governor Lowe’s comments, noticeably on the clear risks in the Australian economy, weighed on the Aussie Dollar. Further news impacted later on, with a key export partner, in China, being downgraded by S&P, possibly affecting future trade.

CANADIAN DOLLAR

The Canadian Dollar fell against most of the G10 currencies last week, as BoC deputy governor Lane’s warnings about the recent appreciation.

Data meanwhile showed inflation missing expectations, with the headline Canadian CPI year-on-year for August coming in at 1.4%. The Average measure, however, which the BoC keeps an eye on, came in slightly ahead of expectations, possibly keeping a hawkish BoC narrative in place.

SWEDISH KRONA

The Swedish Krona fell last week, after Riksbank’s Floden said that it is somewhat premature to withdraw some accommodation from the current domestic monetary stance. The Riksbanks minutes also saw some volatility, as several board members highlighted the issue of overheating in the Swedish Economy yet noted that there are currently no clear signs of this.