Market Report – 05 December 2016

Italian Prime Minister Matteo Renzi has resigned after suffering a crushing defeat in a referendum over his plan to reform the constitution. The Euro has fallen to its lowest level against the Dollar since March 2015, with calls for parity by a number of global analysts. Renewed fears of political instability and turmoil for Italy’s banks could push the Euro-zone towards a fresh crisis.

GBP

Britain’s exit from the European Union is now in the hands of a golf enthusiast, a bell ringer and ex-banker, among others, who sit as judges on the U.K. Supreme Court.

Starting today, 10 men and one woman will decide whether Prime Minister Theresa May needs to hold a vote in Parliament before formally notifying the EU. It’s by far the biggest case in the seven-year history of the court and will also bring with it a level of scrutiny that’s rarely experienced by British judges, even those at the top of the profession.

Sterling was on a rampage last Wednesday after hawkish comments from David Davis, Brexit MP. The currency jumped higher when Davis made comments about the government, who are considering paying for the UK to access the European single market.

Today: UK Supreme Court Hears Government-Parliament Brexit Appeal

Wednesday: GDP Estimate

Friday: Consumer Inflation Expectations

EUR

After Matteo Renzi’s resignation, in a late-night news conference, he said he took responsibility for the outcome and said the No camp must now make clear proposals. Mr Renzi’s failure deals a fresh blow to the EU, already under pressure after the UK’s shock vote to leave the EU in June.

The turnout was nearly 70%, in a vote that was seen as a chance to register discontent with the prime minister.

Unemployment in the euro zone dropped to 9.8%, the lowest level since July 2009.

The odds of the Euro reaching parity with the US Dollar are now above 50%, up from 16% only a month ago, according to options prices. Deutsche Bank predicts 95 cents, Goldman Sachs puts euro parity among its top trades for 2017, while SocGen and National Australia Bank both say it may occur by April, according to Bloomberg.

Today: Retail Sales (Eurozone) and Market Services PMI (Spain)

Tuesday: GDP (seasonally adjusted QoQ & YoY)

Thursday: ECB Interest Rate Decision

USD

The US unemployment rate fell to a nine-year low in November, fuelling expectations that the Federal Reserve will raise interest rates at next week’s two-day policy meeting. Figures from the labour department showed the US economy created 178,000 jobs in November, while the jobless rate fell to 4.6% from 4.9% in October.

“This was the last hurdle on the path to a December hike and it has been cleared convincingly,” said Luke Bartholomew, investment manager at Aberdeen Asset Management.

President-elect Donald Trump complained about Chinese economic and military policy on Twitter on Sunday, showing no signs of a conciliatory approach after a conversation with Taiwan’s president raised hackles in Beijing.

Trump continued some of his hard-line rhetoric on Sunday. ‘’Did China ask us if it was OK to devalue their currency, heavily tax our products going into their country or to build a massive military complex in the middle of the South China Sea?’’

Beijing will be watching closely to see if this is the start of a policy shift in US-China relations or whether it was an unintentional misstep by the incoming President.

Today: ISM Non-Manufacturing

Tuesday: Trade Balance (Oct)

Thursday: Initial and continuing jobless claims

Rest of the World

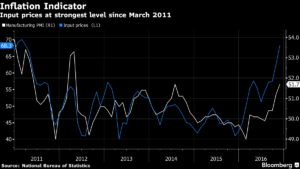

China’s official factory gauge climbed to 51.7 in November, matching the highest level since 2012, while non-manufacturing PMI climbed to 54.7. The index, which is the official gauge of factory output in Asia’s largest economy, matched a post-2012 high, driven by monetary and fiscal stimulus.

The first thing that happened last week after details of the first OPEC deal to cut production in eight years were made public, was an 8% rally in oil.

After months of meetings from Doha to Moscow, it was a 2 am telephone call between two of the most powerful men in the global oil industry that finally broke the impasse.

In the small hours of the morning of November 29th, Saudi Arabian Energy Minister Khalid Al-Falih and Russian counterpart Alexander Novak had talked. Novak promised that Russia was willing not simply to freeze its output, as it had long insisted, but to cut, contributing half of the total supply reduction OPEC was seeking from competitors around the world.