Market Report – 21 November 2016

Phillip Hammond will deliver the Autumn Statement on Wednesday, in which he will reveal the state of the economy and outline the government’s spending plans. He will reportedly announce broad direction, but leave more policy announcements to his colleagues, unlike his predecessor George Osborne.

Wednesday also brings us durable goods orders from the US for October. Japans CPI figures will be delivered on Thursday and UK GDP Q3 (YoY P) will be released Friday.

GBP

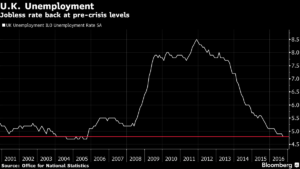

UK unemployment fell to its lowest rate since 2005 in the last quarter, according to the Office for National Statistics. The jobless rate dropped to 4.8% from 4.9% in the second quarter.

However, the economy only added 49,000 workers, half the number forecast and a huge decrease on the previous 172,000 from the previous quarter.

Consumer Price Index inflation fell to 0.9%, from 1% in September, below the 1.1% expected by economists.

The price of goods leaving factories rose by 2.1%, faster than expected and the biggest increase since April 2012. After initially pushing up the prices of raw materials, the recent fall in the value of the pound is now starting to boost the price of goods leaving factories as well,” ONS statistician Mike Prestwood said.

On Tuesday, Bank of England governor Mark Carney told the Treasury Committee that “the thinking now is that inflation is going to go above target. We see more inflation coming through in 2017-18, and then a tail in 2019.”

Inflation has been below the Bank’s 2% target for nearly three years. Last year it was zero, the lowest since comparable records began in 1950.

EUR

The final rush of public opinion polls before Italy’s referendum next month showed voters are leaning toward turning down the constitutional reforms. Four polls published Friday showed the “No” camp in the lead, in a trend that has been predominant for several weeks.

Prime Minister Matteo Renzi has promised to quit if voters reject the referendum reforms, which he says would streamline Italy’s government decisions

A touch over 60% of Italians say they will vote. While the “Yes” vote was unchanged at 37 percent from the previous week, the “No” is up to 42 percent from 40% previously.

Mario Draghi has given a clear signal that policymakers will continue to support the Eurozone economy with monetary stimulus. “Even if there are many encouraging trends in the euro area economy, the recovery remains highly reliant on a constellation of financing conditions that, in turn, depend on continued monetary support. The ECB will continue to act, as warranted, by using all the instruments available within our mandate to secure a sustained convergence of inflation towards a level below, but close to 2%.’’

USD

The Dollar rose for the 10th consecutive day against the Euro, its longest winning streak since the Euro’s debut.

Chair of the Federal Reserve Janet Yellen says interest rates could go up ‘relatively soon’ as Donald Trump’s election has caused no significant change in outlook for US growth. “The evidence we have seen since we met in November is consistent with our expectation of strengthening growth and improving labour markets and inflation moving up,” she said in testimony on Capitol Hill on Thursday. “I do think the economy is making very good progress toward our goals.”

Yellen said she intended to see out her full term at helm of the Fed until January 2018, despite Trump repeatedly calling for her to leave the position early due to her hesitancy to raise rates, which he claims has been artificially slowing down the economic recovery.

Rest of the World

Monetary policy in India has never been as unpredictable as it is now. Having shifted to a committee-led approach, the economy has now been subject to a monetary shock through the withdrawal of 86% of its currency in circulation. Economists are split on whether the MPC should announce a rate cut or wait until the entire currency withdrawal plays out by 31st December. However, the market has already taken a cut as granted.

China’s Renminbi traded near an eight-year low against the US Dollar last week. Donald Trump has repeatedly slammed China in his pre-election campaign, blaming currency ‘’manipulation’’ for the US trade deficit with China.